Legal Bites #01 | New Stock Options Regime for Startups

📌 What is it?

The Startup Law (Law no. 21/2023, of May 25), approved in May 2023, introduced a special tax regime for companies legally recognized as startups in Portugal.

This regime applies to plans offering securities (such as shares, options, or equivalent rights) to employees or members of the company’s corporate bodies.

Outlined in Article 43-C of the Tax Benefits Statute (EBF), the regime brings clear tax advantages:

- Deferred taxation – only when the shares are sold.

- Reduced effective tax rate – 14% on the capital gains realized.

Stock Options

A right granted by the company to the employee or member of a corporate body to acquire shares under pre-defined conditions (e.g. exercise price, type of shares, time frame).

Stock Options Plan

A formal agreement between the company and the employee (or member of a corporate body) defining the rules for acquiring company shares. It is part of the overall remuneration package and sets out how and when this right can be exercised.

💸 What changes?

The new regime introduces a positive tax discrimination for employees and corporate body members of legally recognized startups.

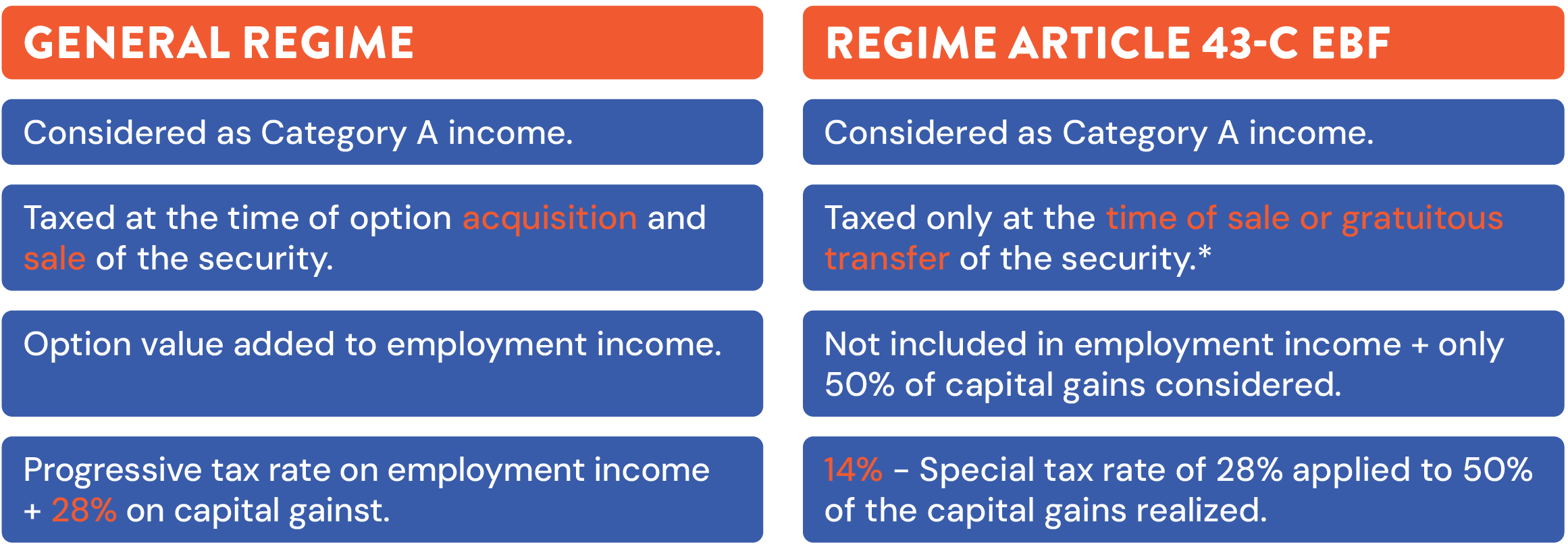

Before (General Regime) vs. Now (New Regime – Art. 43-C EBF):

* Loss of tax residence status in Portugal triggers a tax liability, regardless of whether the shares have been disposed of, with gains calculated in accordance with paragraph 4 of Article 24 of the Personal Income Tax Code (IRS Code).

Category A Income

All income earned by the taxpayer under an employment relationship, pursuant to Article 2 of the Personal Income Tax Code (IRS Code).

Taxation moment

Under the new regime, tax is only triggered in one of the following situations:

- When shares/options are sold;

- When they are transferred gratuitously (e.g. donation or inheritance);

- When tax residency in Portugal is lost.

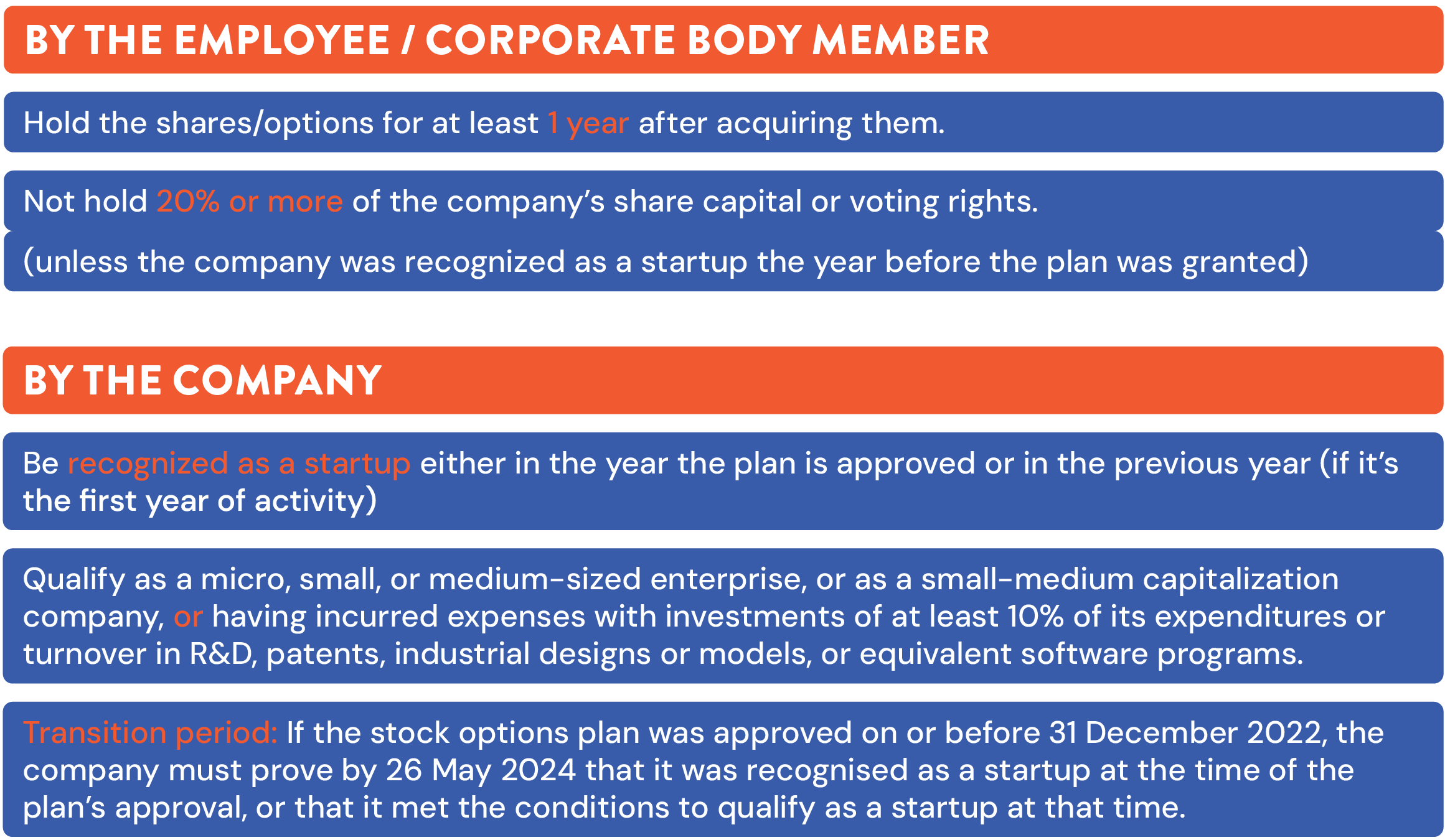

👥 Who is eligible?

To benefit from this regime, both the company and the employee/corporate body member must meet certain conditions.

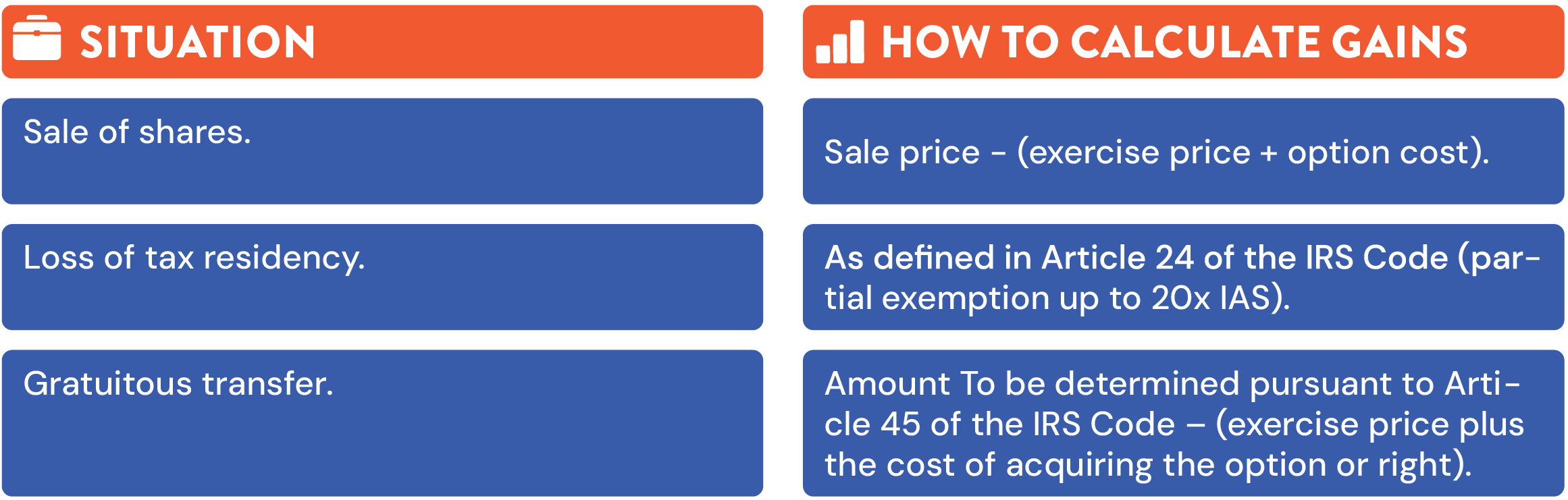

📐 How are gains calculated?

Only 50% of the capital gain is taxed, at a rate of 28%, resulting in an effective tax rate of 14%.

📜 Relevant Legislation

- Law No. 21/2023, of May 25

- Article 43-C of the Tax Benefits Statute (EBF)

- Articles 2 and 24 of the Personal Income Tax Code (Código do IRS)

- Article 36 of the Investment Tax Code (Código Fiscal do Investimento)

LEGAL BITES

Can you chew more than one Legal Bite? 🍽️ Dive into our LEGAL BITES series, where we break down key legal and fiscal topics that impact startups in Portugal. From tax regimes to new laws, we make it easy to digest the complex stuff. Ready for another bite? Check out our other legal bites here!

📌 Note: This content is for informational purposes only. For tailored advice, please consult a qualified professional.

Other blog posts